FinwealthGlobal

Shaping the future of retail finance. It's Not just an app.

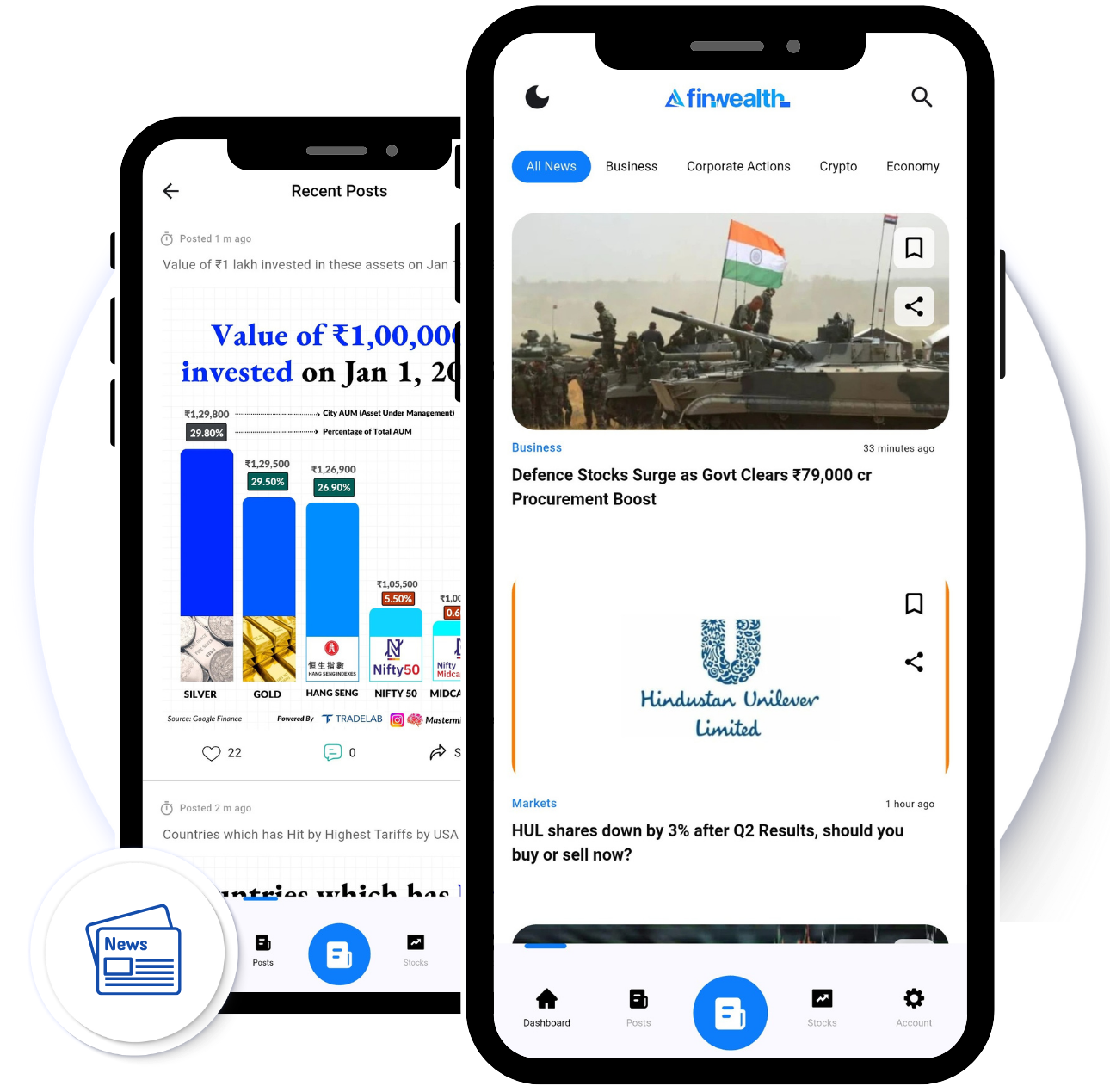

Finwealth is a next-generation financial ecosystem built to empower traders and investors through a seamless, intuitive platform. Founded with a mission to bridge the gap between retail participants and advanced financial markets, Finwealth brings together cutting-edge tools, real-time market insights, and a vibrant community—all in one powerful app.

Active Users

Downloads

News

Year of experience

Who We Are?

India’s first platform dedicated to the ‘Hedged Style’ of investing and trading, featuring a discussion forum designed to help traders and investors minimize risks and avoid losses.

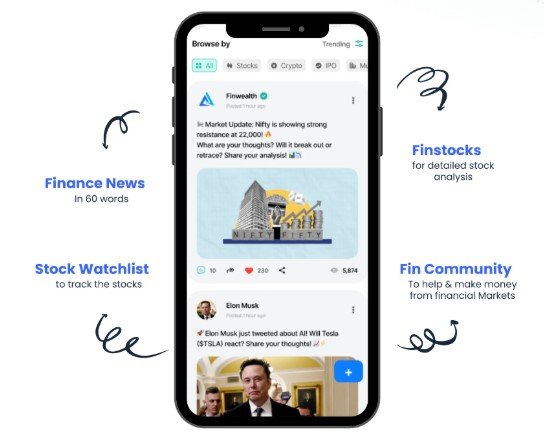

Our Lovely Services

Finwealth is designed to support your journey.

FinwealthGlobal is a dynamic financial venture redefining how people engage with stocks and crypto markets. We provide seamless trading solutions and expert insights across global exchanges, bridging traditional assets and digital currencies for smarter, faster investments.

Smart Trading Tools

We equip users with advanced, easy-to-use trading tools—including real-time charts, technical indicators, and AI-powered signals—so they can make data-driven decisions and execute trades with precision.

Curated Research & Market Insights

No more guesswork. Get daily trading ideas, crypto updates, and market strategies curated by top analysts and seasoned traders—so you’re always a step ahead.

Copy Trading & Expert Portfolios

Follow & learn from top-performing traders. With our copy trading feature, you can mirror expert portfolios & strategies in real-time—perfect for beginners & time-strapped investors.

Community & Learning Hub

Join a thriving community of traders and investors. Discuss market trends, share tips, and learn together through live webinars, courses, and interactive sessions.

Crypto + Stock market

Learn and Trade seamlessly across both equity and crypto markets in one unified experience. Diversify your portfolio and ride opportunities across asset classes.

Goal-Based Investing

We help you align your trading and investing with real-life goals—whether it's building wealth, generating passive income, or planning for the future.